Credit cards or particular loans – Although even now carrying substantial fees for those with very poor credit, standard financial loans/playing cards give more acceptable prices than 300% title pawn APRs.

A prospective borrower heads for the lender Using the car or truck and its title. The lender assesses the car’s price and provides a financial loan according to a share of that quantity.

The application fee is capped at $20, and you’ll pay back not more than 28 per cent in interest. This makes payday different loans additional inexpensive than car title financial loans and some lousy credit rating personalized financial loans.

Since you hardly ever know when you may require more income, figuring out how a car title mortgage is effective and the amount of cash you can get is ideal. Possessing the option of a car title mortgage can provide you with reassurance. When you choose TitleMax® for your automobile title personal loan, you'll be able to rest assured that you choose to’re in good palms.

Getting a payday financial loan may also cross your mind if you’re within a jam, However they’re a financially perilous option Until you’re a hundred% sure you will pay yours back again punctually — and even then they’re nonetheless terribly costly.

You may also utilize a charge card for any dire economic unexpected emergency. Or you could pull funds from your credit card through a income advance.

Pawning your automobile title can be an complete past vacation resort if every other avenue probable has been fatigued initially. But in dire eventualities where standard credit just isn’t a possibility, title pawns existing an unexpected emergency lifeline to find the income necessary. Even then, quite careful thought is needed.

The higher limit of “economical” is mostly thought of as 36% APR. The expenses and cyclical borrowing associated with car or truck title loans make them even costlier.

Financial savings account guideBest price savings accountsBest significant-produce discounts accountsSavings accounts alternativesSavings calculator

Kim copyright is really a lead assigning editor on NerdWallet's loans team. She handles customer borrowing, including subject areas like personal loans, purchase now, fork out afterwards and cash progress applications. She joined NerdWallet in 2016 after fifteen several years at MSN.com, exactly where she held a variety of written content roles together with editor-in-chief of the health and foodstuff sections.

Home finance loan calculatorDown payment calculatorHow A lot household can I afford calculatorClosing fees calculatorCost of living calculatorMortgage amortization calculatorRefinance calculator

Mortgage loan calculatorDown payment calculatorHow much website property am i able to manage calculatorClosing fees calculatorCost of dwelling calculatorMortgage amortization calculatorRefinance calculator

Checking account guideBest checking accountsBest free checking accountsBest on-line check accountsChecking account possibilities

Item title, brand, brand names, together with other emblems showcased or referred to in just Credit rating Karma would be the residence in their respective trademark holders. This website could possibly be compensated as a result of 3rd party advertisers.

Shaun Weiss Then & Now!

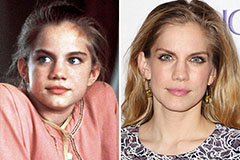

Shaun Weiss Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!